Hear more about the latest deal announcements, news,

IN THE NEWS

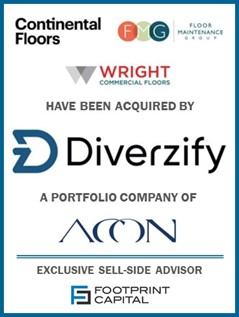

Footprint Capital Advises Continental Floors, Floor Maintenance Group, and Wright Commercial Floors in Sale to Diverzify

Columbus, OH, June 10, 2024 – Continental Floors (“Continental Floors”), Floor Maintenance Group (“FMG”), and Wright Commercial Floors (“Wright”) have been acquired by Diverzify LLC (“Diverzify”), a portfolio company of ACON Investments. Footprint Capital, LLC (“Footprint”) acted as the exclusive sell-side advisor in the transaction. This transaction is a divestiture of the flooring division from Continental Office and the company’s furniture, interior construction, branding, and spatial related operations will continue under current ownership.

With decades of experience, both Continental Floors and Wright Commercial Floors have earned a reputation as knowledgeable full-service flooring contractors and valued partners to general contractors, architects, interior designers, building owners, property managers and corporate facilities groups. Complementing these offerings, the Floor Maintenance Group team specializes in expertly maintaining any type of floor surface, ensuring optimal care and longevity.

“The Footprint team was a pleasure to work with,” said Continental CEO Ira Sharfin. “Throughout the whole process, they provided excellent counsel and timely communication. The Footprint team members worked seamlessly with our leadership group, which made the entire process much more efficient and less stressful. They are true professionals, and I would definitely work with them again.”

“We’re focused on providing our loyal customers ‘solutions at every step’ of their flooring journey,” said Danielle Hunsicker, Diverzify COO. “With the addition of these three brands, we’re welcoming trusted local experts in the OH/PA/WV tri-state region to our network, and thereby connecting their existing customers with the unparalleled specialized flooring and surface care resources available to all Diverzify brands.”

With this newest acquisition, Diverzify successfully expands into the Pittsburgh market and strengthens its Columbus presence. The expansion reinforces the company’s commitment to unifying the historically fragmented commercial flooring and interior services industry and offering clients an integrated national network of flooring experts and skilled installers.

ABOUT FOOTPRINT CAPITAL

Footprint Capital is a boutique investment bank focused on advising owners and operators of privately held companies in the middle market. Footprint’s services include sell-side and buy-side merger and acquisition advisory, private equity and family office deal origination services, ownership transition planning, capital raising, and strategic management consulting. For more information, visit: www.footprintcapital.com.

ABOUT DIVERZIFY

Diverzify is one of the nation’s most comprehensive commercial flooring and facility services provider. Diverzify serves a wide range of industries, providing services from installation to maintenance. It unifies experts, services, and resources in a way that allows Diverzify to offer comprehensive capabilities, strategic client management, specialized application, and a sizable skilled labor force.

ABOUT ACON INVESTMENTS

ACON Investments, L.L.C. is a Washington, DC-based international private equity investment firm that manages private equity funds and special purpose partnerships that make investments in the United States, Latin America and Europe. Founded in 1996, ACON has responsibility for managing approximately $6 billion of capital. ACON has professionals in Washington, DC, Los Angeles, Mexico City, Madrid, São Paulo and Bogotá.